"Inflation is when you pay fifteen dollars for the ten dollar haircut you used to get for five dollars when you had hair." - Sam Ewing, former professional baseball player for the White Sox & Blue Jays

***

The Federal Reserve (Fed) has never telegraphed their intent to raise interest rates as clearly as they have recently calling for seven rate increases in 2022 & four more in 2023 - this to the consternation of investors & borrowers but a delight to the long forgotten saver in America.

Short term interest rate increases are the primary way the Fed uses monetary policy to bring down inflation - & they have finally recognized the need to do just that after a year of inaction.

Interest rates have risen fast as the bond market has not waited for the actual rate increasing action by the Fed. The yield on the benchmark 10-year U.S. Treasury note has risen from 1.496% @ the end of 2021 to 2.995% today, doubling.

Now the Fed's intent & need to raise rates so dramatically was prompted by their recognition that the inflation caused by their participation (creating money by buying Treasury Covid stimulus securities) in the Treasury's cash-in-hand spending programs over the past two years in response to the Wuhan coronavirus pandemic was not transitory as they had thought. That is, for far too long the Fed thought inflation would be short-lived & would not lead to permanent economic damage - they were counting on the supply-chain problems caused by Covid interruptions being corrected without any intervention on their part.

We are seeing the definition of inflation play out - namely, what happens when too much money chases too few goods & services. During the pandemic the Fed electronically printed $5.5 trillion covering Covid stimulus bills while millions of people did not produce goods or were unable to perform services due to the government's lockdown rules - yet people received this stimulus money from the government to purchase the fewer goods & limited services that were available. This is the cause of the current inflation that started to pick up in March 2021 & has continued to accelerate with no definite end in sight. In essence money was created & spent faster than the short handed pandemic-affected economy could produce goods & services inevitably resulting in inflation.

Inflation refers to a general & sustained increase in prices of goods & services in an economy - not just for any single item. Professor Friedman, who gave us the above definition, famously said that "inflation is always & everywhere a monetary phenomenon, in the sense that it is & can be produced only by a more rapid increase in the quantity of money than in output."

The Fed has the congressional mandate to conduct monetary policy "so as to promote effectively the goals of maximum employment, stable prices, & moderate long term interest rates." We can see that the Fed is behind the curve in fulfilling their function.

Right out of the box, on March 3, 2020 Congress threw $8.3 billion in emergency spending @ the Wuhan coronavirus to fund the development of a new vaccine that resulted (with a portion of funding from the CARES Act) in Trump's Operation Warp Speed vacince project, for health agencies & testing, & for small business loan subsidies. Fifteen days later Congress raised the stakes to $100 billion to provide free testing for Covid-19, tax credits for employers who offered paid sick leave, & increases to unemployment benefits & food assistance so you can see the too much money part of the inflation definition actually encouraging the too few goods & limited services part of the definition.

Then on March 27, 2020 the $2.2 trillion CARES Act (Coronavirus Aid, Relief, & Economic Security Act) passed Congress that included direct cash payments to households ($1,200 per adult plus $500 per qualifying child under 17), an additional $600 per week in unemployment compensation through July, bailouts for airlines & other businesses, & loans & grants to small businesses. By the time CARES was done $2.7 trillion had been added to the national debt.

But, to top it off, during the week of December 21, 2020 the fourth, & first since March, Covid relief bill (The Coronavirus Response & Relief Supplemental Appropriations Act) for $900 billion & the $1.4 trillion omnibus Consolidated Appropriations Act for 2021 were both signed into law by Trump. The Covid relief bill included direct cash payments in the form of income tax rebates of $600 per adult plus $600 per child; an increase of $300 per week in federal unemployment compensation; an allowance for employers to voluntarily provide paid leave through March 31, 2021 thereby receiving a payroll tax credit; an extension of the federal eviction moratorium through January 31, 2021 including $25 billion in emergency rental assistance to help renters impacted by Covid-19 to pay for past due rent, future due rent, & utility bills to prevent power shutoffs; a 15% increase to SNAP (food stamps) benefits through June 30, 2021 estimated to be an extra $25 to $30 a month for everyone enrolled in the program; $69 billion for Covid-19 vaccines, testing, & tracing; $3.2 billion to expand broadband access to low-income families; & $100 million for the Administration for Community Living to address abuse, neglect, & exploitation of the elderly.

This ended the Trump portion of economic stimulus bills that contributed to the inflation that started in March, 2021 & grew progressively worse each month until it accelerated in October, 2021 reaching 40 year highs starting in January, 2022. This opened the door for Biden to finish the job by showing we really have one big government party with two wings.

On Thursday March 11, 2021 Biden made his first presidential prime time TV address to mark the one year anniversary of the Covid-19 pandemic in America. The address also coincided with his signing into law the same day of the $1.9 trillion stimulus bill known as the American Rescue Plan Act (ARPA).

Almost half of this gigantic stimulus spending went directly to the well publicized $1,400 per person direct deposits or checks ($8,400 for a family of two adults & four small children), $1,300 per child expanded child tax credits ($5,200 for this same family), bigger food-stamp payments, & $300 per week federal enhanced unemployment benefits in addition to regular state unemployment benefits. And $350 billion payments were made to states - the majority of which went to Democrat states that have been financially irresponsible for decades meaning that states like Tennessee, Florida, Texas, & Georgia bailed out New York, New Jersey, Illinois, & California. For instance, New York received more money from the bill than Florida despite New York having a smaller population than Florida - one of the consequences of the November, 2020 election.

The ARPA also provided 14 weeks of paid sick, family, & medical leave through September, 2021, while reimbursing local governments for the cost of this leave, provided an additional $25 billion for rental relief & $5 billion to cover home energy & water costs for low income people, extended the federal eviction moratorium through September & allowed people with federally guaranteed mortgages to apply for forbearance until September, provided $40 billion to ensure childcare providers can remain open & expanded the childcare tax credit, provided an additional $15 billion to the Paycheck Protection Program in flexible, equitably distributed grants to small businesses to help them reopen & rebuild, & provided $20 billion to support public transit agencies to ensure that workers keep their jobs & routes are not cut from service.

Under Biden's direction Congress also passed a $1.2 trillion Infrastructure bill (Infrastructure Investment & Jobs Act). But thanks to Democrat Senators Joe Manchin (WV) & Kristen Sinema (AZ) the much larger $3.5 trillion Build Back Better bill (which originally included the infrastructure bill) has stalled @ least for now.

Breaking out the cost of the Covid stimulus the past two years: $3.6 trillion under Trump & $1.9 trillion under Biden. Much of the money from the federal spending bills in 2020 went to household savings because of the lockdowns - i.e., much of it wasn't spent right away. As the lockdowns were removed the pent up demand started to come forward & inflation started to pick up in March, 2021 - the very month Biden signed the $1.9 trillion American Rescue Plan Act thereby adding more fuel to the fire. Americans are still holding an estimated $2.5 trillion more than normal stockpile of savings that was accumulated during the pandemic spending spree. Source: Princeton Professor Alan Blinder. And some of this savings will be used for consumption thereby continuing to feed the inflation beast.

From the supply side: the pandemic has produced a gap of about 3 million fewer people in the labor force than what had been projected for 2022 as some 2.6 million people retired earlier than expected between February, 2020 & October, 2021 thereby crimping the supply of goods & services by this measure - see graphic below. And employment is still 1.2 million people below the pre pandemic level. The April unemployment report showed a decline in the labor force of 363,000 people attributed to either lingering fears of catching or spreading Covid or workers thinking that their wages will not keep pace with inflation - some employers complain that workers quit after just a few hours on the job, if they show up @ all. Also hurting supply is the China Covid lockdown, the Russian war in Ukraine, & Biden's policy to destroy the oil & gas industry as he continues AOC's Green New Deal war on fossil fuels. Increasing the supply of oil & gas back to the point where just two years ago America was energy independent would bring down the price of gasoline @ the pump without any action by the Fed.

Click on graphic to enlarge

The most widely reported measure of inflation is the Consumer Price Index (CPI) prepared by the Bureau of Labor Statistics. The CPI measures the weighted average of the prices of a fixed set of consumer products & services meant to represent the broader economy & specifically the things that an average urban consumer buys. The prices in this basket of goods & services are evaluated, including price checking by a workforce of 477 on-the-ground economists who track changing prices for hundreds of thousands of goods & services every month. The final monthly change is known as the CPI inflation. About 80,000 items make up the CPI. See image below for the eight major groups of the CPI.

The CPI is meant to reflect the purchases of a typical urban consumer, which represents 87% of the American population so when you hear the CPI inflation report for the month that is what they are talking about.

Since the above description of the basket of goods & services uses the words "average" & "typical" it is important for everyone to calculate their own individual inflation rate for the sake of accuracy in financial planning as well as having a better understanding of the government's inflation policies that devalue your income & net worth. This becomes obvious when you see that someone who has a greater weighted average of their expenses in medical & housing expenses has a higher individual inflation factor than someone who spends most of their money on things like apparel whose prices rise slower than medical & housing items. That is, if medical costs are going sky high but you are in good health & take no medicine your inflation factor is not affected by high medical costs - the opposite is also true if you are in poor health.

This type of phenomenon can also play out in different regions of the country. The April inflation report showed that CPI inflation was 8.3% year over year for the country as a whole but 11.0% in Phoenix, 10.8% in Atlanta, 9.6% in Miami in contrast to 7.2% in Chicago, 6.3% in New York, & 5.0% in San Francisco.

People are often fooled by what are known as visible price change components in the CPI. For instance everyone knows when gasoline (signs along the highway tell you) & grocery (everything marked in the store) prices are increasing & this realization tends to make people feel everything is high. Compare this to prices of appliances that you may not have bought for years & are not as aware of their costs as you are of gas & groceries. It is best to check your own personal record to see if other items in your budget are increasing as fast as you think gas & groceries are. The results of a detailed calculation of changes in your entire expenses is much better than an opinion you get based on one visible component you see @ a gas pump.

Food & energy prices are the components in the CPI that the Fed has the least control over because they are both traded in the futures markets where their prices are actually determined & can be volatile. For instance, during the two year pandemic West Texas Intermediate (WTI) oil has traded as high as $119 per barrel on March 1, 2022 & as low as negative $37 per barrel when the front month May, 2020 contract price dropped over 300% in the final two trading days of the May contract before the owner of the contract had to take delivery. See graph below. Obviously, the Fed has no control over even less volatile situations that regularly pop up in the futures market.

Food & energy price volatility is the reason that the Fed concentrates on what they call "core inflation" - that is the inflation rate with food & energy contributions stripped out. It is not that the Fed thinks that people don't buy food & energy products but rather they think they have a better control of the core inflation measure than one with these two components that can be distortedly volatile.

Since 2000 the Fed has preferred to use the Personal Consumption Expenditure (PCE) index for inflation prepared by the Bureau of Economic Analysis. Like the CPI this index accounts for the prices that consumers pay for a wide range of goods & services but also more heavily takes into account changes in consumer behavior substituting less expensive items for items that have increased more in price. See graphic below.

The PCE index runs about 2 percentage points lower than the CPI - same economy but different results which is partly why I suggest calculating your own individual inflation factor & just talk about the CPI or PCE when referring to the general economy for the average urban consumer. BTW - the CPI changed methodology along the way - the 7.5% CPI inflation of last January would be more in line with the 10+% CPI readings of the 1970s when rent-housing prices made up a higher contribution to the overall index. Since January that rate has only gone higher.

So how does the Fed intend to bring inflation down?

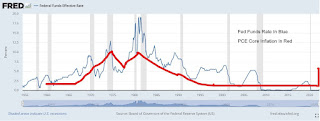

The first way is to increase interest rates as mentioned @ the very beginning of this post. And it just can't be a willy nilly increase here or there. A good starting point is to raise the Fed's policy rate (the Fed Funds rate) so that it is higher than the PCE core inflation rate which is currently running over 5%. The Fed funds rate is less than 1% currently so they have a long way to go. It should stay above the core PCE rate until the Fed's inflation target of 2% for the overall PCE index is reached. The PCE inflation rate was 6.6% in March - a new four-decade high. See graphic below.

You can also check out the relationship using the following graph where the difference between the Fed Funds rate & core PCE inflation is depicted on the blue line read on the left scale. Notice that core inflation was higher than the Fed Funds rate in the 1970s (i.e., the blue line was below zero) that led to the high inflation that Paul Volker had to bring down starting with raising the Fed Funds rate to 10% higher than inflation - a move that was devastating then & would be again today. These two graphs provide a world of information regarding the history of American inflation over the last 60 years.

Since January 2012 the Fed's Federal Open Market Committee (FOMC) - the actual committee that determines short term interest rates - has interpreted a PCE inflation rate of 2% as meeting the Fed's congressional mandate of price stability. The Fed targets this positive number instead of zero because they feel that the price indexes have a slight upward bias meaning that if the reading is 2% the actual inflation rate is probably slightly less than that. Since interest rates & inflation tend to be proportional, having a positive number target implies that the Fed will have somewhat more room to cut interest rates if needed than if they targeted no inflation. And having a positive number target guards against the even worse (than inflation) economic disease "deflation."

Nevertheless, the Fed's program of effectively inducing 2% PCE inflation will reduce the purchasing power of the median-income American household by $1,370 each year if the members of that household's consumption patterns coincide with the methodology used in determining the PCE index.

The second way that the Fed plans to bring inflation under control is to shrink its massive balance sheet passively. Also known as runoff, passive reduction of the balance sheet means the Fed will allow some of the individual debt instruments in its portfolio to mature without reinvesting the proceeds, rather than actively selling them in the open market. The Fed takes the money @ maturity & just like it created the money out of thin air lets it disappear by erasing it electronically thereby actually reducing the money supply meaning there is less money chasing the same amount of goods @ the moment of erasure which is a move in the right direction for bringing inflation down.

Home buyers are already feeling the impact of the mortgage interest increases. The average rate on a 30-year fixed rate mortgage rose from 3.1% @ the end of 2021 to 5.1% @ the end of April bringing the monthly mortgage payment for the median priced house to $1,383 from $1,064 a year earlier. The old rule of thumb to determine if someone could afford a mortgage was to make sure that the mortgage payment was less than 25% of the buyer's gross income. Over time that figure gradually increased to 28% & had stretched to 29% @ the start of 2021. The percentage ballooned to 34.2% of gross income in January 2022 so the Fed's interest rate hikes in April will cut even more people out of the housing market thereby reducing demand for houses as shown by these changes to the old rule of thumb.

But a 5.1% mortgage rate is still less than the current annual inflation rate of 8.3% meaning that over the long term if this higher rate persists the borrower will pay the mortgage off with inflated money. The bank will have unwittingly subsidized the purchase of the house @ their own expense by accepting mortgage payments with money worth less & less in purchasing power every month. This example shows why the Fed has to raise the Fed Funds rate, & in turn commercial banks the mortgage rate, above the inflation rate. The economy is very used to functioning with cheap money & its way past time for the Fed to bring back stability & reestablish value in the economy.

Following his Senate confirmation (80 to 19) to a second four-year term, Fed Chairman Jerome Powell said "The one thing we really cannot do is fail to restore price stability. The economy doesn't work for anyone unless you do that." That is the central point of a healthy economy & only time will tell if he really understands & believes this.

Commercial banks help in the flow of money in an economy by providing deposit & credit facilities. When a commercial bank grants a mortgage they credit the account of the borrower with new funds & write up a loan liability @ the same time. Both sides, assets & liabilities, of the commercial bank's balance sheets expand thereby creating money under what is known as our fractional reserve banking system. As mortgage interest rates go up there will be less demand for mortgages thereby helping to keep the money supply in check through reduced volume of commercial bank's lending programs.

The destructive nature of inflation is also clearly shown by understanding the cost-of-living-adjustment (COLA) that the Social Security Administration (SSA) makes every year. In October the SSA announced that the COLA for 2022 would be 5.9% based on the CPI. But on an annual basis so far the CPI has been higher than 5.9% every month in 2022 so people on Social Security are playing catchup & really will never catch up. They should get another scheduled increase in October 2022 based on these higher 2022 numbers but if inflation keeps increasing it will be to no avail. This principle also applies to worker's salaries - workers are always trying to catch up to what inflation has been.

In summary, America is suffering the highest inflation rates in over 40 years because of the government's deficit spending programs that overstimulated the economy in attempts to help ease the tragedy of the Wuhan coronavirus pandemic. Way too much money was created in America to chase a pandemic reduced supply of goods & services. Although the Fed seems to be prepared to solve this problem the Democrat Biden administration wants to keep on spending. It has never given up on passing the $3.5 trillion Build Back Better (BBB) plan that provides benefits that become part of permanent universal new middle class entitlements & ample funding to get AOC's Green New Deal started before it overwhelms everything. Just imagine how high inflation would be if this BBB plan had passed. The Biden administration could not take inflation any less seriously than they do.

But China does take inflation seriously & sees our lack of preparedness & interest in this regard over the past two years as an important opportunity to move another step forward to reaching their goal of replacing America as the financial leader on the world stage.

While America did nothing for a year but grow the money supply China stayed particularly focused on price stability in China starting with providing far less stimulus than the U.S. during the pandemic.

China relies more on investment than consumer spending to drive economic growth so it is less susceptible to demand-led inflation - the opposite of the U.S. China also maintains enormous reserves of strategic commodities it can call on to contain inflation - it has enough wheat to last a year & a half & enough rice to last over a year. Copper, aluminum, soy beans, & wheat were released in 2021 as needed.

China also uses price controls & protective trade actions.

Now all of these tactics do not follow good economic principles but they are shuffled quickly from one to the other so that so far no long term damage has occured from using them. At least they have a plan including a rainy day fund which is more than we have.

And global investors are buying China's approach. On April 12 the yield on the benchmark 10-year Chinese government bonds closed lower than the comparable 10-year Treasury note meaning investors in the bond market saw less risk with Chinese debt securities than equivalent American debt securities.

Over the past several months Saudi Arabia has also considered accepting Chinese yuan instead of dollars as payment for oil delivery. But the Saudis hedge this bet by continuing to peg the riyal to the dollar in foreign-exchange currency markets.

The dollar has been the world's reserve currency since July 1944 with the signing of the Bretton Woods Agreement that pegged the dollar's value @ $35 per troy ounce of gold with the other countries' currencies pegged to the dollar. On Sunday night August 15, 1971 Nixon took America off the gold standard because the dollar could no longer maintain its value in relation to gold. Inflation from the Vietnam war & the enlargement of the American welfare state were overpowering the value of the dollar & the economy.

The gold standard was completely replaced by fiat money meaning it is used because of the government's order that the currency must be accepted as a means of payment. What really backs the dollar is the future tax generating power of the economy - euphemistically known as "the full faith & credit of the U.S. government."

Now spending money with no regard for any economic principle does not inspire much faith & credit in the U.S. government - especially since we now have a giant competitor that really is an enemy that wants to take over America's prominent economic position in the world.

Inflation is a devaluation of a currency & this leads to trouble as Lenin very well knew when he said "There is no subtler, no surer means of overturning the existing basis of Society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, & it does it in a manner which not one man in a million is able to diagnose."

Consumer prices in China rose 0.85% in 2021 while they rose 7.0% in America.

As usual, very well written article. Where are the congressman and senators we put into office? They seem to be in hiding.

ReplyDeleteDoug - excellent chronology of 2020-2022 fiscal and monetary gaffes that were root causes of inflation. This chronology will be perfect for future 'honest' history classes.

ReplyDeleteRegarding Powell:

I am not sure he simply erred by being over confident supply chain issues would be resolved. Even if they would have been resolved as he expected, debt levels and great disparity between supply of dollars would still pack high inflation rates. Meanwhile, the Fed bought majority of Treasury debt. The responsible action would have been to only purchase a small minority of Treasuries and allow rates to increase. This action may have stopped inflation in its tracks and stop extra Congressional spending. This could have stopped the unnecessary $1.2 Trillion "infra' Bill which was hardly "infra". Rather it was largely "pork" and "climate change related". For these and other reasons, I rate Powell as one of the worse or the worse Fed Chief of my lifetime (I am 65).

Regarding: "Increasing the supply of oil & gas back to the point where just two years ago America was energy independent would bring down the price of gasoline @ the pump without any action by the Fed.":

Absolutely. Furthermore, inflation would be much lower had we maintained energy independence (and extended that by flooding global markets with world's cleanest Fossil Fuels). Instead 2 extreme problems emerged: (1) Inflation and very likely (2) Russia Ukraine invasion as Russia was profiting with the high oil prices due to Biden Admin was against US fossil fuel.

Furthermore, our Gang Green Team is comprised of fake environmentalists. If they were truly concerned about air quality, no way would they support Biden Admin policy of swapping US world's cleanest fossil fuels for worlds most environmentally unsafe from enemy nations.

Read results of this policy (just learned from co2.earth):

April 2022 recorded most CO2 ever. Results listed below. Yes- it is largely from fossil fuels. However, starting in early 2021, the world’s cleanest fossil fuels (U.S.) started swapping that for the most environmentally unsafe from Russia, Mid East, and now Seeking Venezuela. This was an utter failure as renewable green energy could not negate the impact of US producing less clean fossil fuels. We all desire renewable green energy. But we must do it reasonably in stages. Hence, increase US fossil fuel production simultaneously while aggressively developing green energy and electronic vehicles. We need more private entrepreneurs like Elon Musk. source: co2.earth 422.06 is the all-time high for daily CO2 levels. View the details and records for atmospheric CO2 on daily, weekly and monthly time scales. Daily CO2: 422.06 ppm Apr 26 2022 NOAA Monthly CO2: 420.23 ppm April 2022 data Weekly CO2: 420.37 ppm Mar 7-Apr 2 2022 data Yearly CO2: 416.45 ppm 2021 data

Times are tough on multiple fronts. We must do all we can to reverse the economic debacle we are in. I encourage all readers to carefully vote in upcoming primaries. I live in Congressional District NJ-11 and am very active supporter and campaigner for a 1st generation Mexican-American, 3 time Iraq war vet, successful entrepreneur - runs a health services company in NYC. He will work across the aisle to codify Energy Independence, optimistic any veto will be overridden. More info -- click here for Toby Anderson's website.

I don’t understand much about interest rates etc. but I know this govt. thinks nothing of spending trillions of dollars with your $ like water!!! I pray we’ll survive Biden and minions presidency. I hope Trump gains the gift of wisdom and prudence to carefully choose his words and criticisms and that he has an ego diminishment!!!!!!

ReplyDeleteExcellent post, I understand the concept.

ReplyDeleteThe interesting part is the Democrat states receiving the bulk of the money.

ReplyDeleteDoubtful if this helps them.

These states will vote for anyone with a D after their name, sorry to say including Good old New Jersey.

What has to happen if the Republic has a chance to recover without a really ugly revolt is for Republicans swamp the Dem in 2024. Literally take at least 60% of the House and majority in the Senate with strong no nonsense candidates, tell the McConnell's of the party, their days as the leaders are over, and these people will have to learn how to handle the media, something they have been severely lacking in.

The ability to explain their position in simple terms and when challenged by the unenlightened media and Democrats take the offensive and force them into trying to explain their asinine theories and policies. In other words don't let them up for air.

Can this be accomplished, who knows?

But if they take control and let the McConnell's and their 220 batting averages run things there is no chance of a long term turnaround.