"I strongly oppose eliminating the pay raise for civilian federal employees & will work with my colleagues to have the pay raise included (in spending bills). Our public servants have been getting shortchanged for years." – Congresswoman Barbara Comstock (R-VA) who is in a tight reelection campaign in the northern Virginia suburbs right outside of Washington, D.C.

click on graphic to enlarge

The above graphic shows that federal government civilian workers continue to do just fine, as they have for decades, compared to private sector workers – so Congresswoman Comstock doesn't have to worry about their compensation. Average total compensation (i.e., wages & benefits) for a full-time year-round civilian with a high school or less education working for the federal government clocked in @ over $100,000 per year. The above graphic shows that it is not until the professional degree/doctorate level that the private sector total compensation exceeds federal government civilians' total compensation.

The Bureau Of Economic Analysis (BEA) reported that in 2016 federal government civilian workers had an average annual wage of $88,809 - about 50% more than the $59,458 annual average wage that private sector workers earned in 2016. See graphic below that shows the wage growth & widening wage gap since 2000 – excludes the U.S. Postal Service.

click on graphic to enlarge

According to BEA data, in 2016, the average annual total compensation for federal government civilian workers was $127,259 - 80% more than the $70,764 annual total compensation for private sector workers. See graphic below.

click on graphic to enlarge

Long time readers of RTE will remember the figures from the following graphic that I presented in previous posts over the years. The compensation gap has been somewhat reduced for the private sector versus federal government civilian workers as indicated above. The compensation gap for the almost 20 million state & local government workers has been reduced also – it was 42% on average in 2016 substantially lower than the 76% shown on the graphic below.

click on graphic to enlarge

The above described compensation gap is rooted in the fact that federal government workers are a powerful special-interest group with effective lobbyists. Federal government unions actively oppose legislators who support restraining worker pay – just ask Congresswoman Comstock (see quote above) as she campaigns for reelection in her northern Virginia district that has a large number of federal government civilian workers.

See graphic below that shows the growth of the membership in public employee unions from less than 20% of the total in 1973 to the majority in 2009. As recently as the 1950s there were no unions for government workers. In 1962 JFK signed executive order 10,988 which allowed unionization of the federal workforce – this also was the genesis of the unionized public work force in many states & cities. This led to the large membership growth of public employees unions such as The American Federation of State, County, & Municipal Employees (AFSCME), the Service Employees International Union (SEIU), & the National Education Association (NEA).

click on graphic to enlarge

We don't have to think long or hard to see the problem the 114 million private sector workers, who pay the salaries & benefits of the the 22 million federal, state, & local government employees, are having with the above described compensation gap.

Private sector workers can work decades longer @ lower wages than many public sector employees. It is common for private sector workers to still be working in their 60s, 70s, & 80s & paying taxes that support inflation adjusted pensions plus lifetime free healthcare benefits of much younger public sector employees who retired in their early 50s. It is only human nature for this development of events to cause resentment of people's fellow neighbors – unless they do an honest evaluation of their own culpability or ask themselves why they didn't join a public sector employer if they thought this seeming gold mine employment could continue for a lifetime of work.

But of course there are problems because the consistent creation of the richness of wealth under a growing dominant public sector regime cannot be maintained as the graphic below shows.

click on graphic to enlarge

The above graphic shows that from 2001 to 2016 employer's contributions to state & local pensions increased four fold while for the same period the funding ratio dropped from fully funded to below three quarters funded meaning that accrued liabilities increased faster than the growth of the economies in many states including NJ, IL, CT, NH, & KY. These states, & many others, would have to raise billions of dollars more, mostly through taxing the private sector – either individuals or corporations, to even have a chance to adequately fund the promised pension benefits.

Robert J. Sartorius ASA, MAAA, FCA, provides the latest egregious example of private sector taxpayer abuse by local government when he writes in the WSJ "nowhere in the free marketplace can such guarantees be made" referring to the matching of the assumed funding rate of pensions by taxpayers if the actual rate earned on employee contributions is below the rate set by New York City in their pension funding calculations. That is, if the current assumed 7% investment funding rate of return is not met on employee contributions taxpayers make up the difference. This NYC taxpayer liability is an example of the creative exploitation politicians can foist on the private sector.

Meanwhile the U.S. Census Bureau's annual report for 2018 entitled Income & Poverty in the United States: 2017 was released on September 12 & highlighted that median household income was $61,372 in 2017, an increase in real terms of 1.8% from the 2016 median of $60,309 (2017 CPI-U-RS adjusted income). This measure includes both private & public sector incomes & reports the composite for the country – i.e., the higher incomes of the public sector as described above will raise the income levels indicated in this report.

A good portion of the 2016 – 2017 increase in household income was the result of more Americans working longer hours as the U-6 unemployment/underemployment rate dropped as more part-time part-year workers found year-round full-time work.

From 1978 to 1999 the inflation-adjusted median household income rose @ a pitiful annual compound rate of 0.70% per year from $52,089 to $60,062 – both years in 2017 dollars. Since 1999 the median household income, in constant 2017 dollars, never surpassed the 1999 level until 2016 as indicated above – a miserable annual compound rate of 0.36% per year over this 38 year period. Please note that household incomes did go up & down during these years – the annual compound rates are calculated for illustration only to show the effective growth rates from the start of the periods considered to the end points.

The above described phenomenon continues to play out – the Labor Department reported that private-sector hourly wages rose 2.9% in August compared to a year earlier while the Consumer Price Index (CPI) increased 2.7% for the same period. Also, the fiscal year 2019 defense appropriations bill includes a 2.6% military personnel pay raise meaning that members of the military will lose purchasing power if the CPI continues to increase @ the August pace.

Now there have been many posts on RTE over the years regarding income mobility – i.e., it is not the same people in the top quintile every year or the bottom quintile. As older higher paid workers retire each year (currently 10,000 per day) they are replaced by younger lower paid workers so even though the median household income growth was pathetic, as indicated above, many people did see good income growth as they moved from the bottom quintiles when they started work toward the top quintiles as their careers' progressed & then back down the rungs as they entered retirement.

There are boom periods & recessions but over a person's working lifetime (say 22 to 62) their income typically takes about 40 years to double in real inflation adjusted terms – an annual compound increase of 1.8% per year in real terms - the increase realized between 2016 & 2017 for the median household. The higher your starting salary the higher your final salary & standard of living by this measure.

Say you started work in 1978 @ a salary of $10,000 per year when you were 22 years old. If you retired in 2018, @ age 62, you would have been making $76,800 if you doubled your starting salary in real inflation adjusted terms.

Stop & think of the purchasing power & standard of living in 1978 of a $20,000 annual income – they were very good.

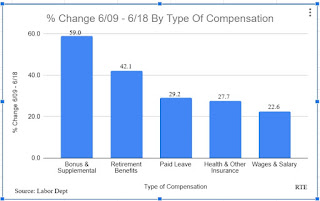

Because of the U.S. skills gap – i.e., not enough qualified Americans to fill the number of job openings - many firms have changed the compensation type paid. See the following graphic that shows wages & salaries increased 22.6% from 2009 to 2018. During that time inflation increased 17% so the real wage gain per year was a little less than one third the 1.8% per year average annual figure needed to double your salary over a lifetime of work. But companies have shifted compensation toward benefits, as indicated in the graphic below, & away from baseline salaries except for employees deemed strategically important, so total compensation is a better measure of how workers are doing. For instance, from 2009 to 2018 the increase in the inflation adjusted value of bonuses & supplemental pay was over 7 times greater than the increase in the inflation adjusted value of wages & salaries.

click on graphic to enlarge

The effect of the Tax Cuts & Jobs Act of 2017 is in line with the above change in compensation trends – namely, companies continue to minimize additions to their fixed labor costs (i.e., permanent payroll – wages & salaries). Companies concentrate on being more competitive like reducing their prices by subtracting the portion of eliminated corporate income taxes previously embedded in prices thereby providing the opportunity to increase market share. They can also increase capital investments @ a faster rate, increase cash reserves, increase investment in employee training, increase acquisitions, pay higher dividends, increase hiring @ a faster rate, increase employee base salaries, bonuses, incentive pay, & benefits like 401(k) matching shares, & increase the rate of share buybacks.

The above information shows the history, that is where we have been the past several decades regarding wage, salary, & total compensation growth for both the public & private sectors.

To see where we could have been please look @ the following graphic & in particular focus on the increasing slope of the green line (earnings of men) from 1960 to 1973, after which it declined & then leveled off for the next 44 years. Yes, the real median annual earnings for men has never been higher than it was in 1973 measured in 2017 dollars.

Using the data from Table A-4 of the aforementioned Census Bureau's 2017 annual report I calculate that the growth in real median annual earnings for men between 1960 ($38,991) & 1973 ($55,317) was 2.75% per year. Had this growth rate continued @ the same rate the typical male worker would today be making over $182,400 per year.

So now we know where we have been, where we are, & where we could have been. To find out all the reasons why the American middle class was cheated out of the economic growth & prosperity they were on track to achieve 44 years ago click on the referenced post below.

click on graphic to enlarge

govt workers received decent salary and great benefits, I know, my father was postal foreman and retired after 43 yrs service.

ReplyDelete