"If Hillary (Clinton) had been elected, we would have had more regulation & higher taxes. Trump was elected; we have less regulation & lower taxes." – Byron Wien, Wall Street executive - Blackstone Group L.P. This statement by Mr. Wien encourages each American to decide for themselves whether "it (is) improbable the wealth created by government spending will fully compensate for the wealth destroyed by the taxes imposed to pay for that spending." - Henry Hazlitt, Economics In One Lesson – page 37 from the Chapter entitled Taxes Discourage Production. Hazlitt's statement is the bedrock economic question separating statists from libertarians.

***

Earlier this month the Department of Labor's Bureau of Labor Statistics (BLS) reported the unemployment statistics for December. The official headline measure of unemployment, U-3, stayed @ 4.1% – the lowest level in seventeen years for the third straight month, black unemployment fell to 6.8% – the lowest level since 1972 when records were first kept for black unemployment, & Hispanic unemployment came in @ 4.9%, which was just above a record low. In addition, the initial jobless claims for the week ending January 13, a proxy for layoffs across the country, was the lowest for claims since February 1973.

But unemployment statistics are just one part of the puzzle that adds up to faster economic growth – which has been meager since the recession ended in June 2009. Please note the government's headline unemployment statistics can be misleading – people counted as employed in determining U-3 could be working as little as an hour a week.

Employers are still having trouble finding qualified workers. See graphic below that shows 391,000 more job openings than hires in November, 2017 – the last month for which data are shown on the graphic, with the number of hires actually slowing in November 2017, prior to the passage of the new tax law in December.

Payrolls grew only 1.4% in 2017. U-6, the unemployment measure that includes the total unemployed (U-3), plus all persons marginally attached to the labor force including discouraged workers who have stopped looking for work, plus the people working part time who want full time employment increased in December to 8.1% from 8.0% in November. And the share of workers 25 to 54 years old is still below the prerecession level in December 2006 – 11 years ago – for both employment & labor force participation (see graphic below).

click on graphic to enlarge

Although U-6 is the broadest & most complete picture of unemployment & underemployment that the government tracks I have recommended a U-7 category that would include all of U-6 plus those employed full time who make a fraction of their former pay. U-6 & U-7 give the most complete picture of those relying on their wealth spend down to live on, whether that of friends or family, which is an excellent measure of the unhealthiness & misery of a job market.

Click here to hear President Kennedy explain the supply side economic principles that are the key to achieving economic growth - the increase in a country's productive capacity that results in prosperity, wealth creation, financial independence, success, strength, & rising standards of living for the American citizenry. The Tax Cuts & Jobs Act of 2017 includes many of the principles President Kennedy embraced in the above video & is the shot in the arm that businesses have been waiting for. James Dimon, CEO of JPMorgan Chase, recently said the new tax law was "a big, significant positive, & much more of it will fall to our bottom line in 2018 & beyond."

In fact, less than a month after President Trump signed the new tax bill into law "many people feel the economy is on fire" - Charles Payne FBN. This "on fire" feeling is a much better measure of where the country is headed than government statistics on unemployment as people anticipate Trump, the business man, working to return prosperity to the citizenry by removing them from government dependence & making America once again a land where free enterprise thrives. So far, over 100 companies have given hundreds of thousands of workers bonuses, pay hikes, & improved benefits – such as doubling the employer matching share of 401(k) accounts - as a direct result of the lowered tax rates in the Tax Cuts & Jobs Act of 2017. Americans For Tax Reform tallies at least 985,101 Americans (and counting) are receiving what ATR calls "Trump bonuses." Just let me know if you would like the complete list of the 100+ companies that have so far participated in tax relief & I will send it to you.

With regard to the "Trump bonuses" Spellex, a Florida-based software development firm founded in 1988, not only gave each of their employees $1,000 bonuses but filled out the memo section of the employee bonus check to say "Trump Tax Cut and Jobs Act." See image below.

Mike Huckabee also reports that Trump has eliminated 22 existing regulations for every new regulation posted in 2017 – Trump's business-friendly regulation-reducing administration coupled with the new tax bill provides the catalyst for businesses to respond with the bonuses & other benefits indicated above that start to reverse the secular stagnation that BO wanted everyone to believe was the new normal of slow economic growth centered around government dependence.

Socialist economies have never advanced anywhere in the world & the following graphic comparing Reagan's capitalistic free enterprise economy to that of BO's mixed – socialist – government dependent economy shows the dramatic difference in the recoveries that Americans are expecting to positively realize once again under Trump now that a pro growth tax plan has finally been passed into law.

The following graphic indicates that economic growth is a function of labor & productivity powered by capital investment. Stanford economics professor John Taylor teaches that economic growth equals employment growth + productivity growth. Productivity growth is powered by increases in investment, innovation, & entrepreneurship. Long term, the economy grows because of capital & savings, including savings that children running lemonade stands, or washing pans in a bakery for allowance money, deposit in passbook saving accounts. A great way to get started in becoming an entrepreneur.

The reduction in the rate of corporate income tax, the switch to a territorial tax system from a world-wide tax system, & the inclusion of the "full expensing" provision in the new tax bill that allows companies to immediately deduct the cost of capital investments from their tax bills instead of writing the costs off over several years, where inflation takes a mighty toll, can only add to the productivity enhancing investments that companies make. Under BO's administration labor productivity lagged as new investment barely managed to offset depreciation – source Phil Gramm & Michael Solon.

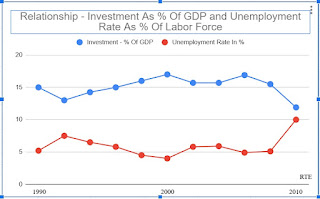

The following graphic traces the investment ups with the unemployment downs & vice versa from 1990 to 2010 in perfect harmony. Solving our real unemployment & underemployment problem of not producing enough good paying jobs does not have to get any more complicated than unleashing capitalists to invest in productivity increasing plants & machinery. Innovation is the production of knowledge & high paying jobs will result from innovative investments if the workforce is properly trained so they can take advantage of the improved job opportunities.

click on graphic to enlarge

Look for, & make note of, those petty political enemies of Trump who for no good reason, are against everything Trump does or proposes, who deny & fight against any benefit the new tax law brings, thereby showing they are not for the American citizenry, & not for the economy to grow with people realizing enhanced prosperity & financial independence. Such anti-Trump people include detestable politicians, the hostile anti-American media, prowling, stealing, & cheating opportunists, blindly partisan, uncompromising, opinionated, assertive, authoritarian, unyielding, & inflexible propagandists who really are not looking out for you & they could not be showing it more clearly than they do with every tiresome attack on President Trump – no matter what he says or does.

In short, things are in place, & have already started, to get better. The people I describe above – they're rooting against America.

Doug

ReplyDeleteMany thanks for the outstanding economic analysis, especially most telling graphs - like the 8 pairs contrasting a private sector approach with a Government centric approach. These are the Reagan vs Obama immediate responses to inherited severe recessions. No comparison, the private sector always wins because it maximizes real GDP per your equation listed capital, labor, and productivity.

Let's all note that Trump fully understands that a private economic approach works best at all stages of economic cycles, as it optimizes productivity of both capital and labor.

Given polls suggesting a growing effect ion for socialism in the US, it is imperative that all who understand the analytics presented here with our friends, neighbors, acquaintances. Instead of focusing on political discussions, let's focus, to max extent possible, economics discussions supported with nuggets of pure evidence presented in your post.

Very well done and I know more are coming !